When employees hop in their cars to run errands for work, employers might feel released of liability if a kind of out-of-sight, out-of-mind way. Employees are in their own cars, and for which they better have their own insurance. If they cause an accident, some bosses feel like that’s the employee’s problem, but sometimes the liability does fall on the employer. Lawsuits can be brought against an employer for an employee’s negligent acts while working off premises and workers’ comp can apply if the employee is hurt off premises while on the clock. Of course, when insurance is involved, you can bet it’s complicated so let’s take a look at how and when an employer can be held liable for employee accidents.

Vicarious liability puts the liability of an employee on the employer while the employee is serving the employer. An employer can be held liable for an employee’s negligent actions while working (or traveling for work). Vicarious liability gives victims the right to sue employers for the damage employees cause while on the clock. So for example, if an employee drives to the bank for her employer and injures someone in an accident, the victim could sue the employer for damages. Suing an employer is usually more lucrative than suing an employee so victims can use this law to get the most out of a lawsuit. Vicarious liability can be a nice loop hole to get more money, but it’s also an important protection.

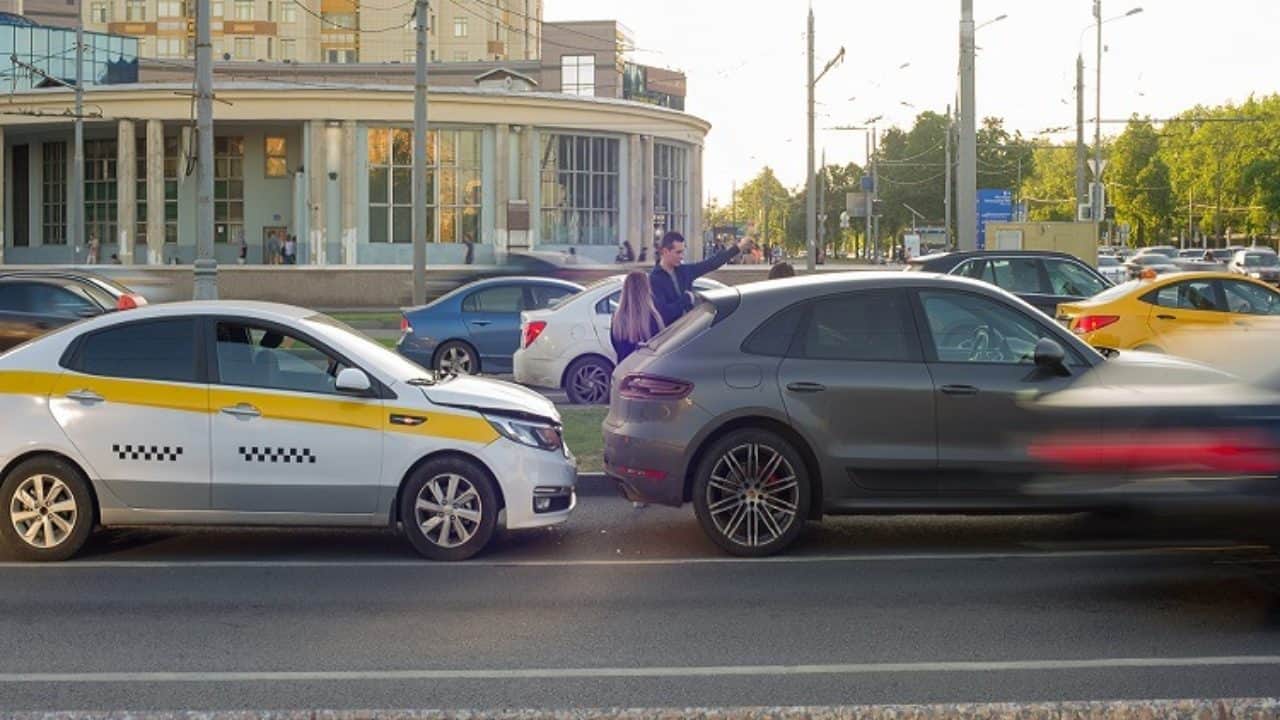

The thing to understand here is that vicarious liability can make a company liable for something that happens off premises. If an employee drives somewhere for work purposes and gets into an accident and badly injures someone or collides with another car, the employer can be sued to cover the damages that the employee can’t afford to pay.

So what about the employee’s car insurance? Shouldn’t the employee’s car insurance take care of any damages or injuries? Yes, it should and will in most cases. The problem arises when the employee doesn’t have enough coverage. This can happen when there are multiple victims in an accident. All of the victims’ judgements combined might cost far more than a normal policy covers and so the victims go to the next in line, the vicariously liable employer. The same might be true for damage done to an incredibly expensive car. If an employee totals a $300,000 car, the employee’s insurance probably wouldn’t be enough to cover it.

An employer should protect itself against this eventuality by adding the appropriate coverage to their business auto policy. The extra insurance adds coverage beyond what the employee’s insurance covers. Having this coverage doesn’t mean that the employee’s insurance doesn’t get used in the case of an accident. The insurance follows the vehicle so if an employee was in an accident in their own car, their insurance is primary. The employer’s insurance kicks in if the employee’s insurance wasn’t enough to cover the damage.

Employees can be eligible for worker’s compensation if they were injured while driving their personal vehicles for work related purposes. Again, if an employee was insured at the time of the accident, the employee’s insurance pays for injuries up to the covered amount. After that coverage is drained, the worker’s comp could cover further injuries or lost wages.

The employer may be held accountable when an employee is commuting to and from work, the employer is not liable for the employee. If the employee stopped in a coffee shop after running a work errand but before returning to work, they could not make a claim against the employer. Likewise, an employee could not make a claim against the employer if the accident happened after completing a work errand and heading home. The employer’s liability does not include damage to the employee’s vehicle or the cost of the deductible.

These cases include many details and are not easy to navigate without the assistance of a qualified legal professional. Remember, each case is unique, so contact HURT-511 for more information on workers’ comp statute and our personal injury lawyers help injured workers recover the benefits to which they are entitled by law. For a free consultation with an experienced workers’ compensation lawyer, call us toll-free at 800-4878-511 or complete our online form. Our firm handles accident and injury claims throughout all five boroughs of New York.

HURT-511 operates in all boroughs of New York including all Bronx neighborhoods, namely: Bedford Park, Belmont, Fordham, Highbridge, Hunts Point, Jerome Park, Kingsbridge, Morris Park, Morrisania, Mott Haven, Parkchester, Riverdale, Spuyten Duyvil, Throgs Neck, University Heights and Woodlawn.

Trusted Reviews

Trusted Reviews